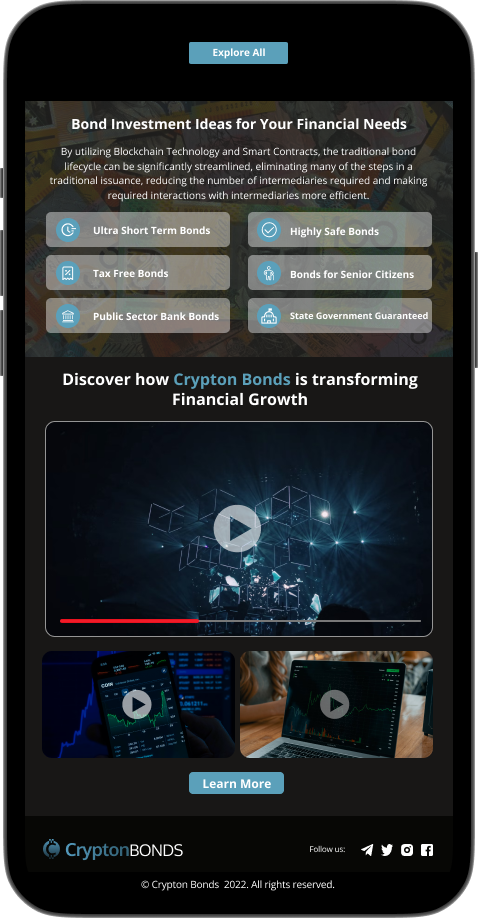

A unified marketplace for issuing and investing in tokenized fixed-income products.

Crypton lets banks & fintechs create compliant tokenized bonds and gives investors a clean discovery → purchase → portfolio experience on a regulated rail.

Fragmented tooling and unclear flows reduced trust and conversion.

Issuers, investors, and compliance teams worked across disjointed systems (manual legal handoffs, confusing custody choices, and inconsistent discovery), increasing time-to-first-purchase and drop-off.

One product, two roles — education-first UX and progressive disclosure.

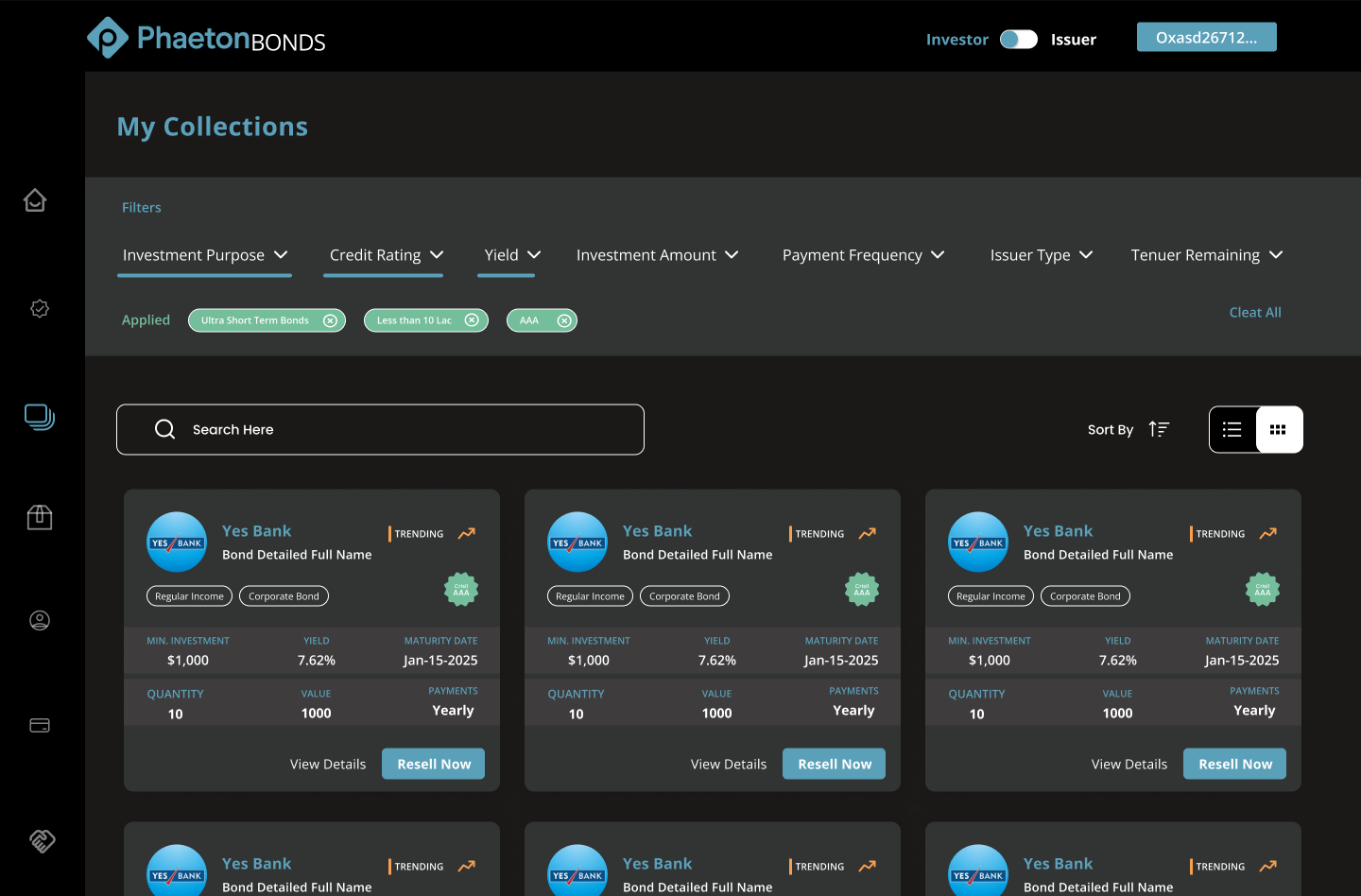

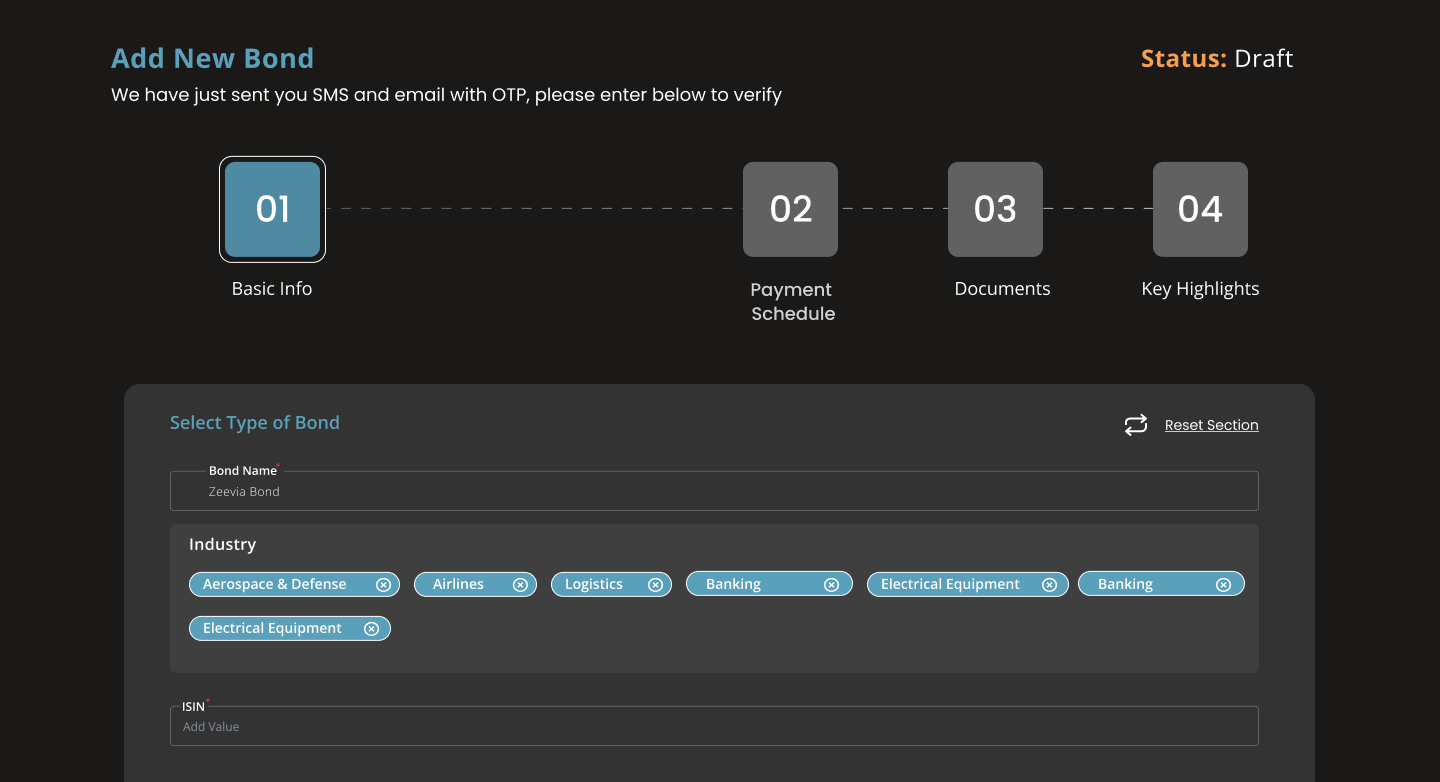

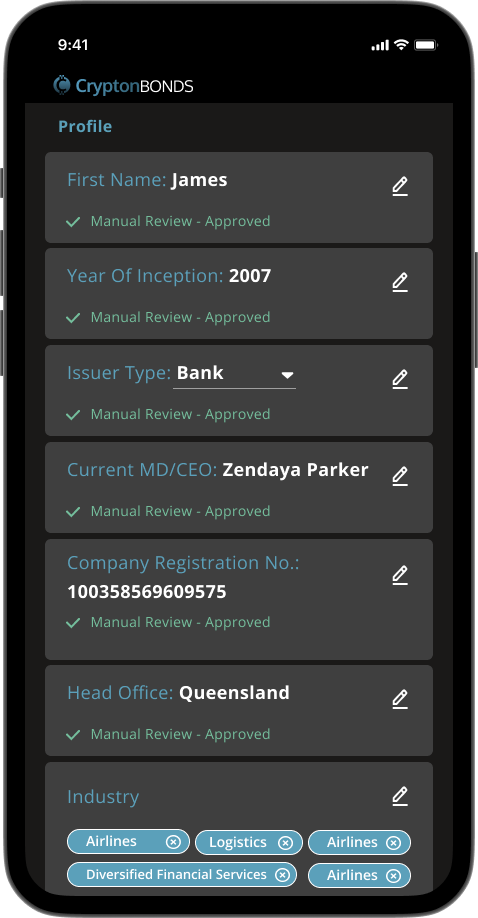

Investor/Issuer mode toggle, guided issuance wizard, just-in-time KYC, plain-language risk summaries, and simplified custody flows reduce friction while keeping compliance visible.

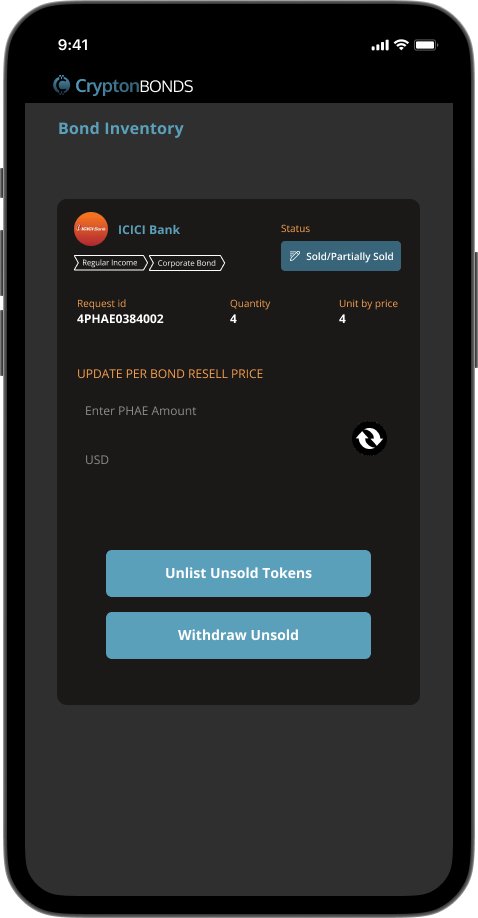

Single product with Investor/Issuer mode

Shared components & IA avoid duplication and reduce cognitive switching.

Progressive disclosure of legal terms

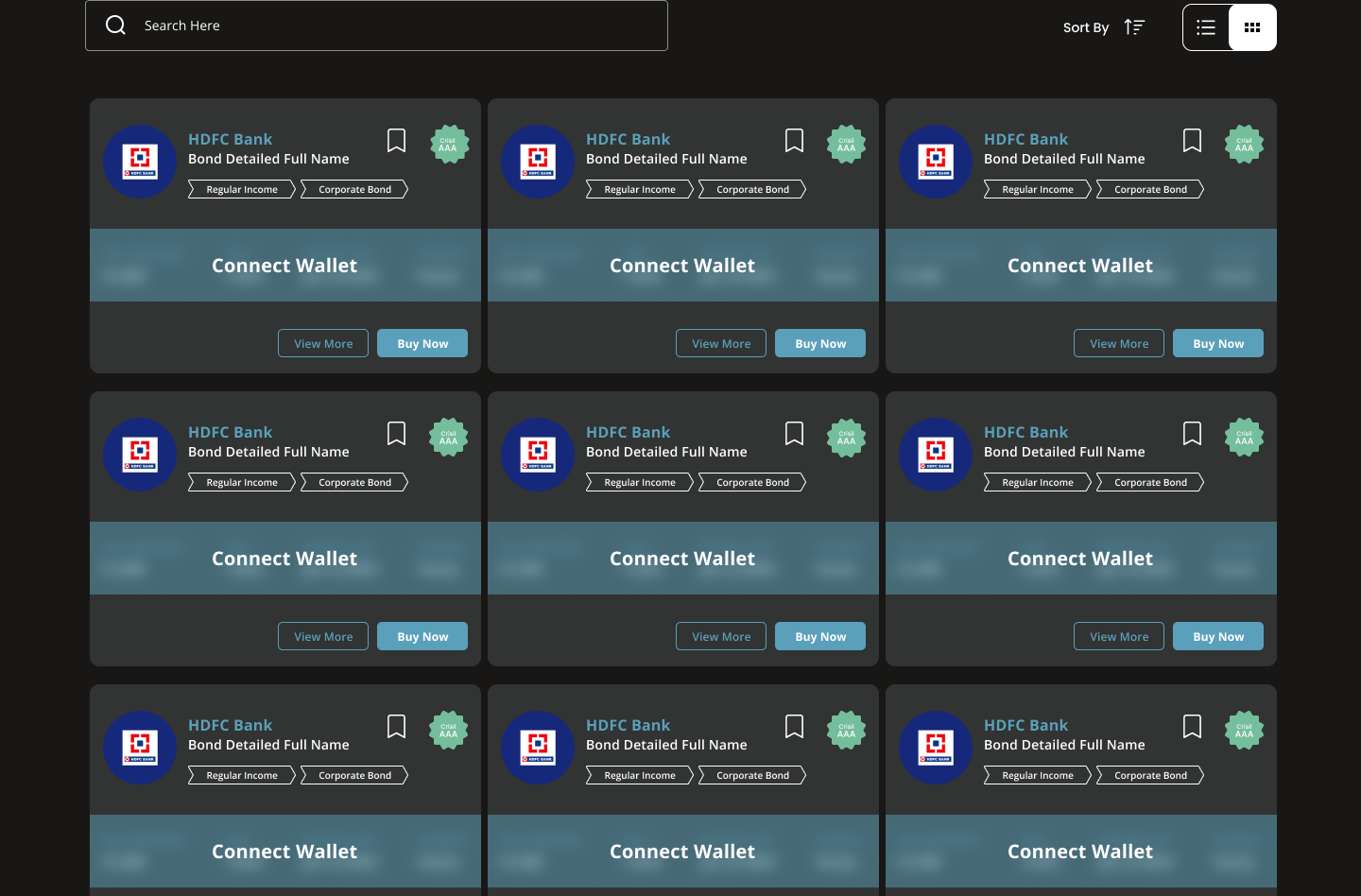

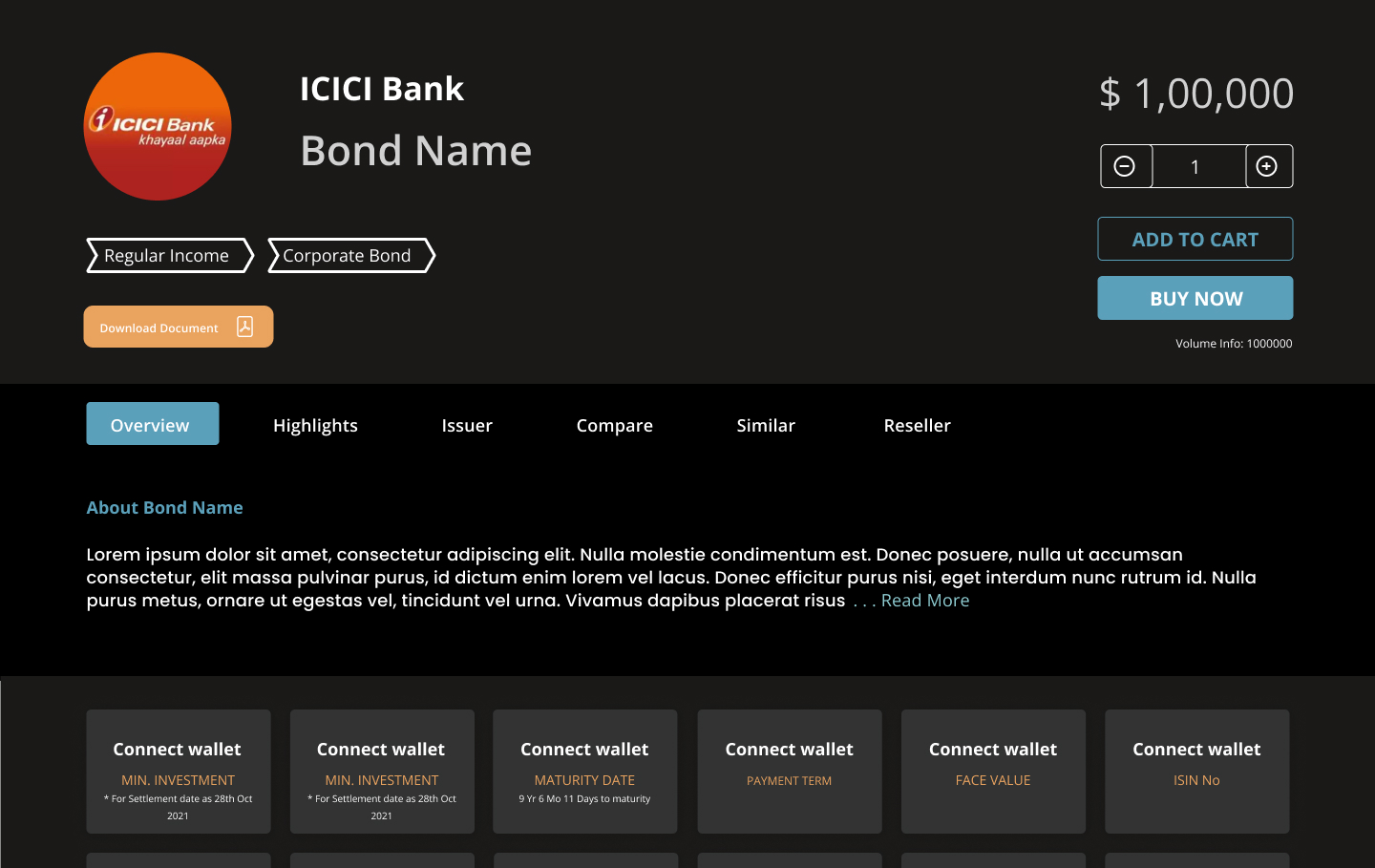

Public summaries with full legal text behind sign-in balanced trust and conversion.

Signup-boosting strategy

Reveal certain details post-registration to encourage account creation without blocking comprehension.

Design principles that guided decisions

- Education-first — teach before asking for commitment.

- Progressive disclosure — surface only what’s necessary.

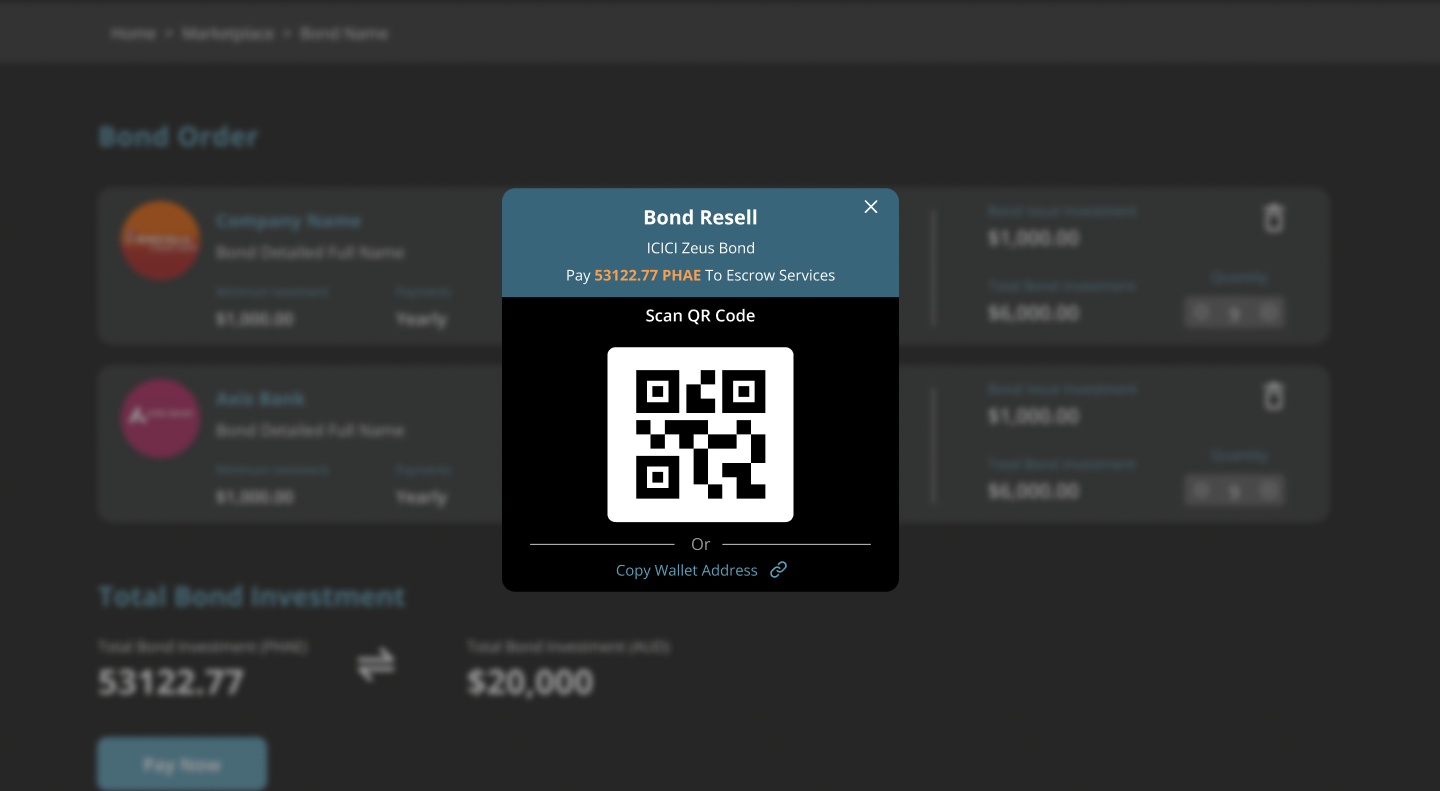

- Trust-forward — issuer verification, audit links, transparent fees.

The visuals show where these were applied: onboarding education, issuer dashboards, and flow guardrails.

Core UX patterns

Mode toggle, progressive onboarding, guided issuance wizard with step recovery.

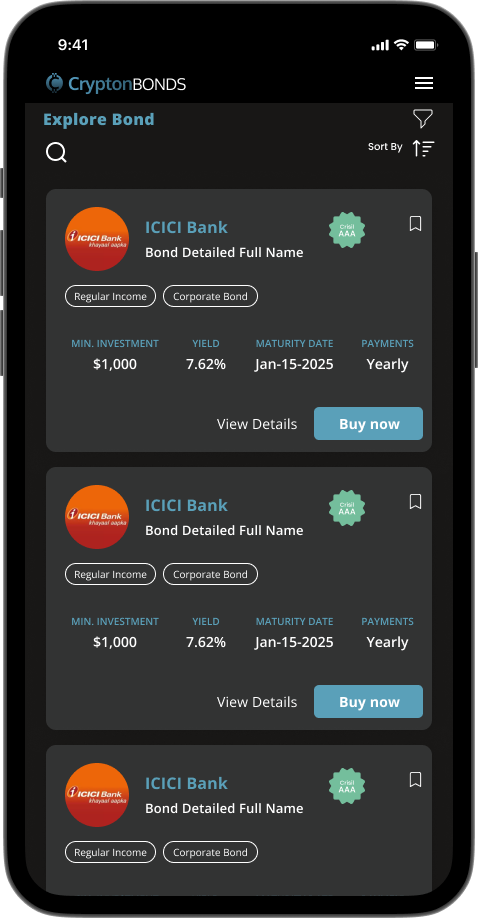

Discovery & decision support

Card summaries, facets, comparisons, and scenario calculators for faster decisions.

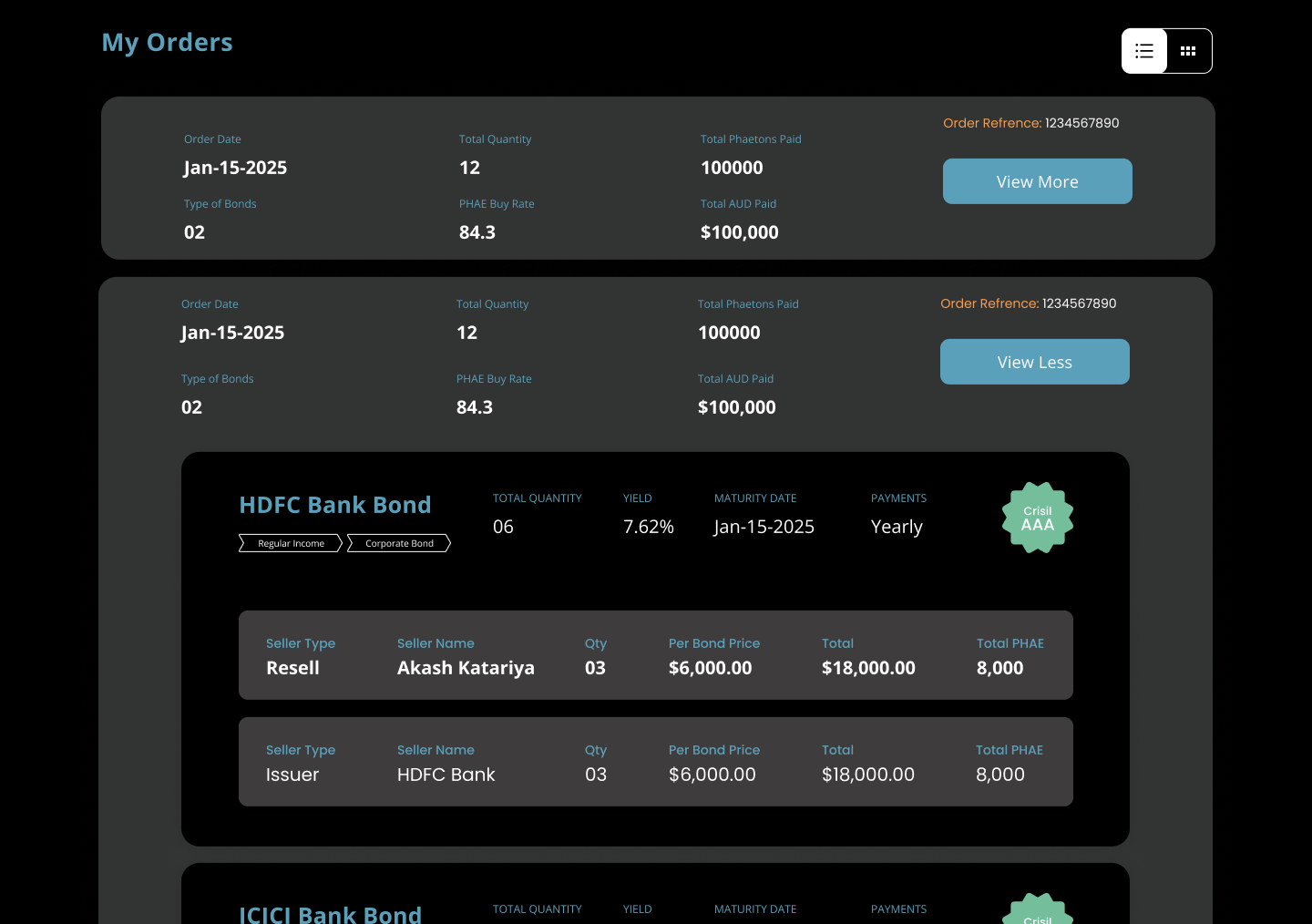

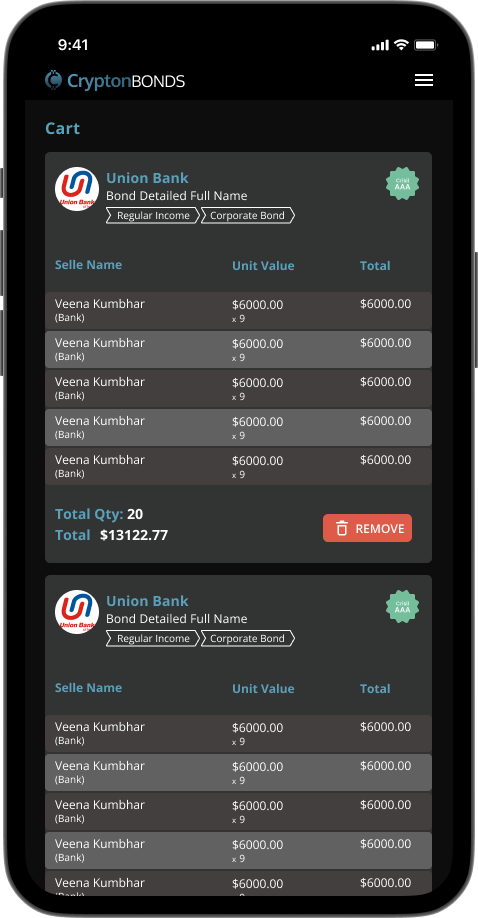

Transaction & custody

Clear custody defaults, pre-purchase checks, receipts, and an auditable trail.

Measured improvements from prototypes & pilots

Mobile screenshots — 3 across (row 1) and 3 across (row 2)

Use portrait mobile images (replace assets/mobile-1.png ... mobile-6.png)

Next steps

- Add advanced custody & institutional workflows.

- Improve secondary market depth visualization.

- Measure LTV and long-term retention.

Reflection

Designing for two roles with shared objects demands systems thinking. Early experiments and shared success metrics moved opinions to evidence, accelerating product buy-in and delivery.